Accounting transactions affect the accounting systems and financial processes in a. On April 24, 2020, the Board of Governors issued an interim final rule amending its Regulation D to delete the six per month limit on convenient transfers from savings deposits. For all entities, financial and accounting transactions are inevitable in daily operations.

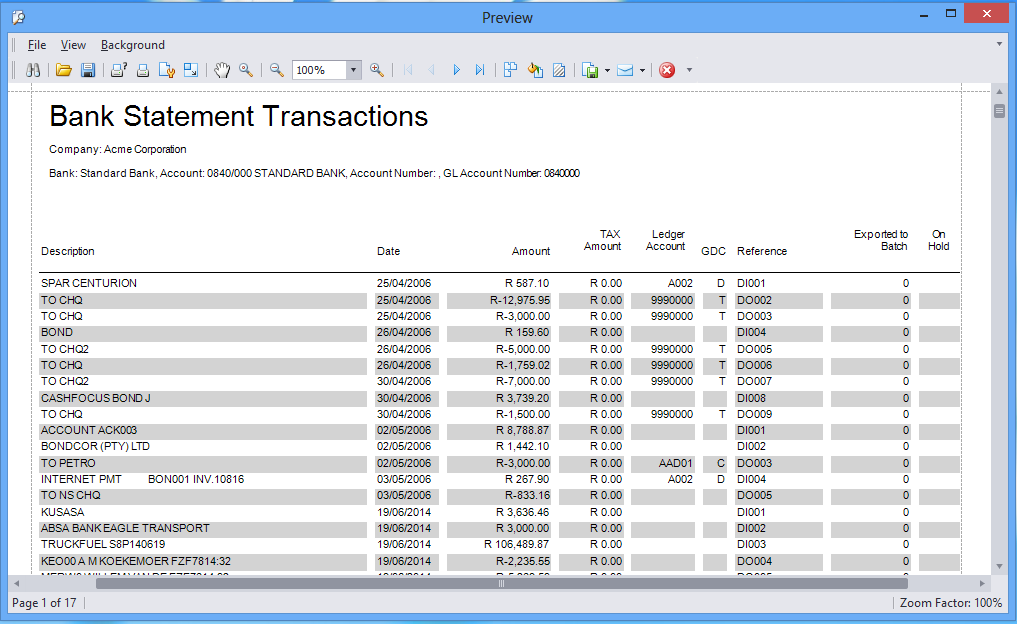

Usually, it impacts a company’s financial status and financial statements directly. In doing so, NACHA maintains a list of over 80 return codes. An accounting transaction is any business activity that can have a monetary impact. The National Automated Clearing House Association (NACHA) manages the ACH Network. Once opened, you can expand the timeframe to view more information.īecause this feature doesn’t change existing functionality, it’s available automatically and doesn’t have to be enabled using the Feature management workspace. The Automated Clearing House system, used by businesses in the United States, enables companies to electronically transfer funds between financial institutions in a matter of a few days. A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions. The Accounting source explorer displays data for a narrower timeframe because multiple lines shown here could have been summarized into the single entry shown on the Voucher transactions page. When you select Transactions, all transactions will display for the main account you select.Ĭlick the Accounting source explorer button to display information from Accounting source explorer. These buttons open pages that let you select specific information to view.Ĭlick the Transactions button to open the Voucher transactions page. Two new buttons, Transactions and Accounting source explorer, have been added to the Main account page. Now you can access transaction detail directly from the Main account page.

#Transaction account trial

Currently this information is viewed using the Trial balance list page, which is time consuming because balances are calculated for all accounts based on the dimension set selected. Organizations often require that employees review transaction detail to verify their main account balances. For the latest release plans, see Dynamics 365 and Microsoft Power Platform release plans. For the latest documentation, see Microsoft Dynamics 365 product documentation. Demand-deposit accounts, negotiable order of withdrawal NOW accounts, automatic. This content is archived and is not being updated. A checking or similar account from which transfers can be made to third parties.

0 kommentar(er)

0 kommentar(er)